Data Science in Finance - Special Program in Collaboration with Sony CSL

Update: December 9, 2021ICU, using its Autumn break, conducted a special program "Data Science in Finance" aimed at nurturing next-generation financial professionals for realizing a sustainable society. The program was held over a period of five days from Wednesday, November 24, to Tuesday, November 30.

The program was held for the first time this year with the cooperation of Sony Computer Science Laboratories, Inc. (Sony CSL), where Prof. Hiroaki Kitano (Other Distinguished Professor of Sciences, who joined ICU in April this year) heads as President and CEO, Director of Research. A total of 25 undergraduate and graduate students of the university participated in the event.

The program featured, in addition to a lecture by Prof. Kitano titled the "Global Agenda and Future of Japan," a special lecture by Mr. Hiromichi Mizuno, former Executive Managing Director and CIO of the Japan Government Pension Investment Fund, who was appointed as the United Nations Special Envoy on Innovative Finance and Sustainable Investments in December 2020, as well as a lecture by an overseas institutional investor. The lectures touched on topics in the most advanced areas of data science and finance and the students learned what kind of discussions and initiatives were in progress regarding various sustainability issues being faced by the world such as climate change and environmental problems.

As part of a practice exercise, the participants learned a method that uses deep learning for evaluating new investments in addition to the existing investment evaluation methods. They also made presentations on the utilization of technology in public pension fund management using actual financial data.

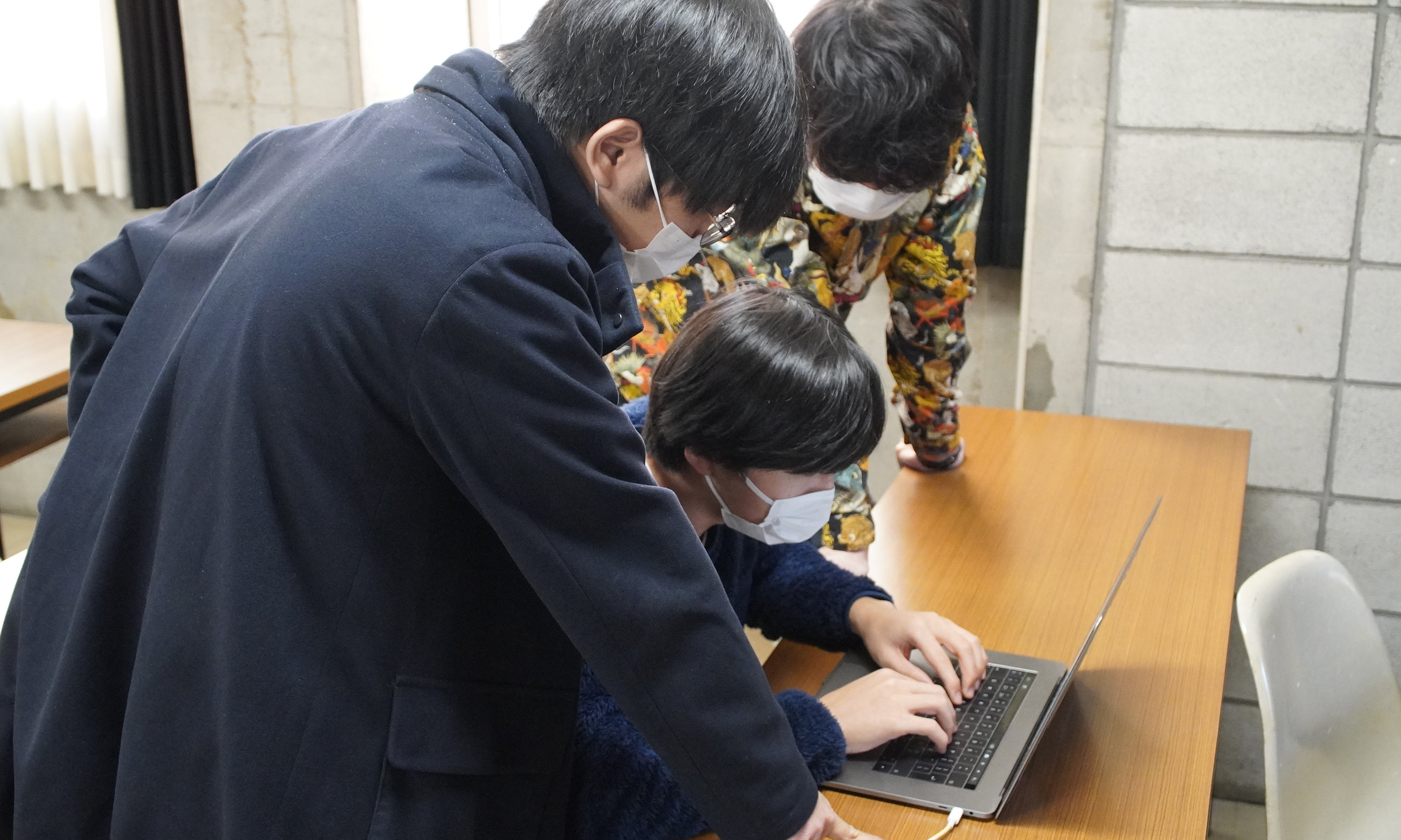

Students engaged in a group exercise

The following are comments from students who participated in the program.

● The contents of the lectures, exercises, and speeches were profound and I learned so much in the program. Unlike regular college classes, which start with theory, the starting point of this program was actual issues and it was very interesting because the mindset was to find out how to approach such issues using theories and technologies.

● The lectures and speeches were very easy to understand and interesting. In addition to the Japanese public pension program and social security system as well as quants and machine learning methods, it was a rare and great opportunity to learn about the current situation in various countries such as Canada and the United States and listen to talks by the former chief investment officer of GPIF as well as the lecture on the current trends and future outlook by Prof. Kitano.

● The program was productive. I was not acquainted at all with the financial field, but I became very interested. If this program had been held last year, I might have gone on to study finance.

● The program plainly explained specialized technologies such as quants and AI and taught us enough so that we can put it into practice, so I learned a great deal. It also motivated me to continue studying, which I am planning to do on my own. It was a rare opportunity to listen to experts from overseas as well as Prof. Kitano and Mr. Mizuno who are active in the frontline and ask questions freely. It was an amazing experience.

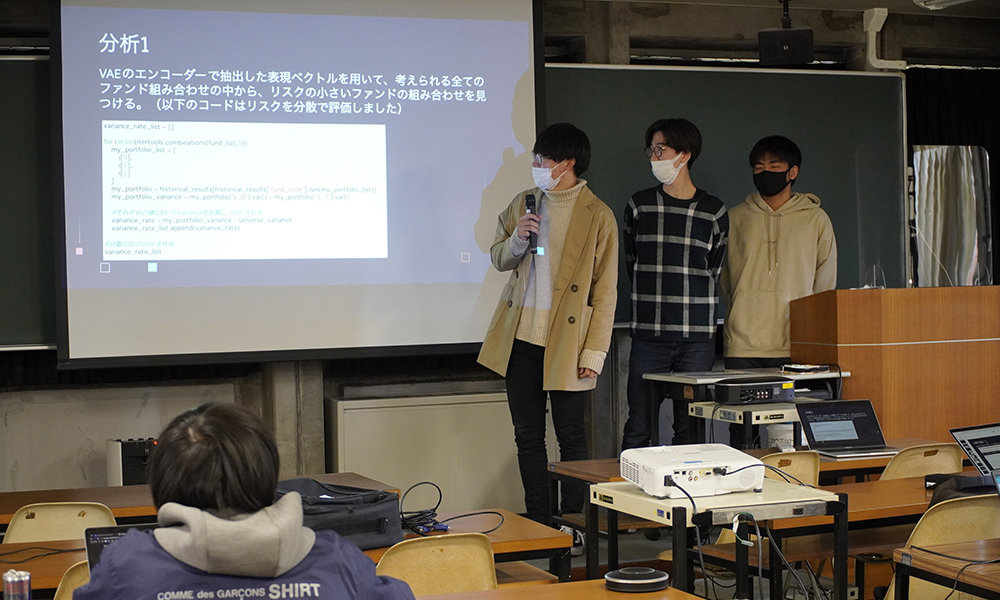

Students giving a presentation regarding evaluation of investment targets in public pension fund management